You must also meet whats called the 2 floor That is the total of the expenses you deduct must be greater than 2 of your adjusted gross income. You must meet legal requirements for opening a bank account.

Tax Deductions For Tradies Give Your Refund A Boost

Beginning in 2018 unreimbursed employee expenses are no longer eligible for a tax deduction on your federal tax return however some states such as California continue to provide a deduction on your state tax return if you qualify.

Can you write off work expenses on your taxes. That means your taxable income for the year would be 60000. Expenses you can only deduct with the actual expense method and expenses you can deduct with both methods. If youre a sole proprietor or run a single-member LLC then claiming car expenses like gas is very straightforward.

Your trip must consist mostly of business. Thats all yes as long as these are legitimate business expenses you can write it off. Business or networking may be the reason why attorneys purchase season tickets.

To deduct workplace expenses your total itemized deductions must exceed the standard deduction. The problem with deductions only arises when you start claiming personal expenses as business deductions that have nothing to do with your business. It is generally permissible to deduct 50 of business meal and entertainment expenses according to the IRS.

Table of contents 1. What can i write off on my taxes if i travel for work. You need to leave your tax home.

As it stands now the following employee or job related deductions CANNOT be applied with your 2021 return but are scheduled to return beginning with 2026 Returns. If you would like to see these deductions return and have your furniture deducted on taxes again in 2020-2021 tax years then contact your government representatives. Your tax home is the locale where your business is based.

A RT is a bank deposit not a loan and is limited to the size of your refund less applicable fees. This can include things like business miles with the mileage deduction usual business expenses the cost of using your home as an office and much much more. You list the employee expenses on Form 2106.

You can deduct workplace expenses accrued prior to 2018 but unfortunately you can no longer deduct business expenses if you are an employee in most cases. The good news is you can write off mileage on taxes. On average people discover write-offs worth 1249 in 90 seconds.

If you have to take out an insurance policy for work such as malpractice insurance you can also deduct your insurance premium. If youre a business owner who hops in your personal car to meet clients or pick up supplies you should be taking a tax write-off for the business use. Only if Congress decides to reinstate the moving expense deduction.

Traveling for work isnt technically a business trip until you leave your tax home for longer than a normal work day with the intention of doing business in another location. There are two types of car expense write-offs. The tax code allows self-employed workers to write off various expenses related to their business.

You can only deduct certain employee business expenses in 2021 - the majority of these expenses are not tax deductible but there are certain employment categories which may qualify. Dues to Professional Societies and Unions. You can electronically file your return and receive your refund without a RT a loan or extra fees.

If however you are in the Armed Forces Reserves a qualified performing artist or have employee expenses related to an impairment you can deduct certain items from your income. Keeper Tax automatically finds tax deductions among your purchases. In this article we explain what business mileage is tax-deductible and the different methods the IRS provides for business use car write-offs.

As you know now freelancers independent contractors and small business owners who sometimes drive for work can claim gas on their taxes if they choose to write off actual vehicle expenses. The expenses must be ordinary and necessary. Available at participating offices.

It is important to remember that networking events may not be deductible just because they involve networking. Eligible pieces of clothing can be claimed alongside your other deductible expenses on Schedule C of your tax return. You have to be self-employed to write off your work clothes.

Can you write off moving expenses 2020. You can write off licensing fees regulatory fees and occupational taxes that you pay to the government to be able to work in your profession. You dont need to be afraid of tax deductions its literally written in the tax law.

If youre a regular W-2 employee youll either have to swallow the cost of any uniforms. There are various ways the IRS provides for deducting mileage expenses. To write off a work expense as an employee you must itemize deductions on Schedule A of your Form 1040.

HR Block Maine License Number.

How To Claim Your Work Related Car Expenses In 2020 Gofar

Can I Write Off Home Office Expenses During The Pandemic Cbs8 Com

The Big List Of Small Business Tax Deductions 2021 Bench Accounting

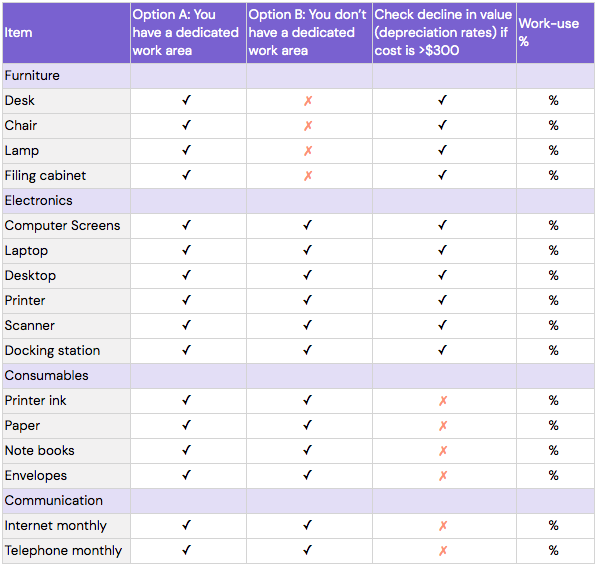

How To Claim Working From Home Deductions Kearney Group

Recording Other Work Related Expenses On The Airtax Tax Return Airtax Help Centre

Tidak ada komentar:

Posting Komentar