Under the Tax Cuts and Jobs Act you can no longer deduct miscellaneous employee business expenses subject to the 2 adjusted gross income threshold. Keeper Tax automatically finds tax deductions among your purchases.

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

The rule is that you can deduct the cost of clothing as a business expense only if.

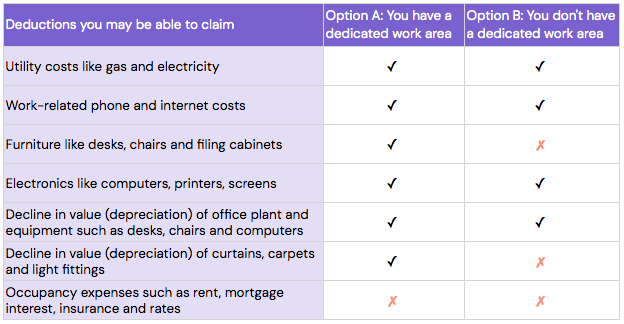

Can you write off work expenses 2020. As part of the home office deduction you can write off some of your utility expenses taxes insurance repair and depreciation. One thing that you should keep in mind however is that the IRS will. However you cannot deduct more than the income you received when you did not perform the.

Temporary flat rate method. As with your home office other tools that are necessary for you to work as an independent contractor can also be deducted. 35 of all qualifying expenses up to a maximum of 3000 for one childdependent.

Thats all yes as long as these are legitimate business expenses you can write it off. Employees who are still working from their couches cant take a write-off on their 2020 federal return yet a handful of states will allow you a tax deduction for costs employers wont reimburse. Thus your monthly expenditures for wireless services can be deducted.

On average people discover write-offs worth 1249 in 90 seconds. Additionally you can deduct the cost of baggage passport application laundry phone calls and tips. If so you may be wondering if youre allowed to take the home office tax deduction for those expenses on your 2020 federal tax return.

You can deduct taxi fares airfares and train tickets. Like you cant just buy a Porsche and write it off from. For instance if you work as an online freelancer you will need to have reliable internet access.

Up to 6000 for two or more childrendependents. You can either deduct a portion of your actual driving expenses based on your work-related mileage or you can use the standard mileage rate set by the IRS each year. Eligible employees working from home in 2020 due to the COVID-19 pandemic.

But other types of expenses can qualify too. To deduct workplace expenses your total itemized deductions must exceed the standard deduction. You dont need to be afraid of tax deductions its literally written in the tax law.

You can claim 2 for each day you worked from home in 2020 due to the COVID-19 pandemic up to a maximum of 400. To be able to write off the cost of a work-related trip expenses the trip must last one year or less. Perhaps you work as an employed officer but have a side gig in the field where youre a 1099 worker.

If you paid for a babysitter a summer camp or any care provider for a disabled child of any age or a child under the age of 13 you can claim a tax credit of either. Click to see full answer. However you must be able to prove that the reason for the trip was professional in nature.

You must also meet whats called the 2 floor That is the total of the expenses you deduct must be greater than 2 of your adjusted gross income and you can deduct only the expenses over that amount. The problem with deductions only arises when you start claiming personal expenses as business deductions that have nothing to do with your business. It is essential for your business.

Can Realtors write off clothing. This includes amounts you repaid for a period when you were entitled to receive wage-loss replacement benefits or workers compensation benefits. Table of Contents show 1 Why is the Child.

Your employer is not required to complete and sign Form T2200. It is not suitable for ordinary street wear. Get a tax break for your work clothes.

The importance of the 2 floor. If so then you could deduct various costs as theyd be considered business expensesWhen you file your tax return youd fill out an extra form called Schedule C where you can report expenses for travel equipment uniforms cell phone service insurance fees and. Weve been talking mostly about classes.

The rate was 535 cents per mile in 2017 545 cents per mile in 2018 58 cents per mile in 2019 and 575 cents per mile in 2020. Repayment of salary or wages - You can deduct salary or wages you reported as income for 2020 or a previous year if you repaid them in 2020. Course-related books supplies and transportation.

The short answer is. Here are the basic categories you should look out for.

How To Claim Working From Home Deductions Kearney Group

Can I Write Off Home Office Expenses During The Pandemic Cbs8 Com

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

The Big List Of Small Business Tax Deductions 2021 Bench Accounting

Working From Home Tax Deductions Covid 19

Tidak ada komentar:

Posting Komentar