The vast majority of W-2 workers cant deduct unreimbursed employee expenses in 2020. There are heaps of work-related expenses you can claim on tax such as home office costs tools and equipment conference fees and work-related travel.

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

The most common itemized deductions are those for state and local taxes mortgage interest charitable contributions and medical and dental expenses.

Can you deduct work expenses in 2020. Actual cost method For the period 1 July 2019 to 29 February 2020. Under the Tax Cuts and Jobs Act you can no longer deduct miscellaneous employee business expenses subject to the 2 adjusted gross income threshold. With more people working from home than ever before some taxpayers may be wondering if they can claim a home office deduction when they file their 2020 tax return next year.

The Tax Cut and Jobs Act TCJA eliminated unreimbursed. It covers all deductible expenses and can be used by multiple people working from home in the same house However you must have kept a log of the hours that you worked from home to backup the numbers inputted into the tax return. The short answer is.

Record keeping for work-related expenses. Additionally the following are job-related expenses that were non-deductible in past years and will remain non-deductible for 2021. IRS Tax Tip 2020-155 November 16 2020.

That 80 cents covers running expenses like electricity and gas phone and internet expenses and everything else. IRS Tax Tip 2020-98 August 6 2020. There are two ways you can choose to calculate your deduction for home office expenses.

For the period 1 March 2020 to 30 June 2020. Claims cannot be made using this method prior to March 1 2020 and the scheme is set to be reviewed after June 30 as the ATO decides whether to keep it or not. The home office deduction allows qualifying taxpayers to deduct certain home expenses on their tax return.

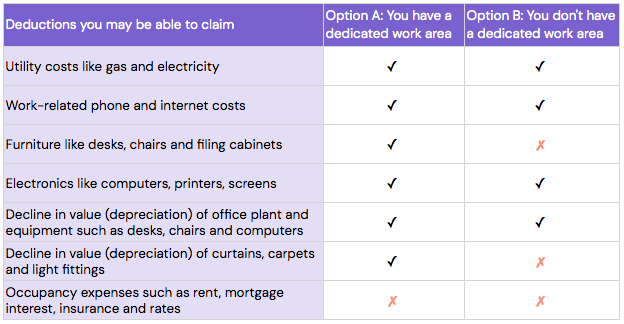

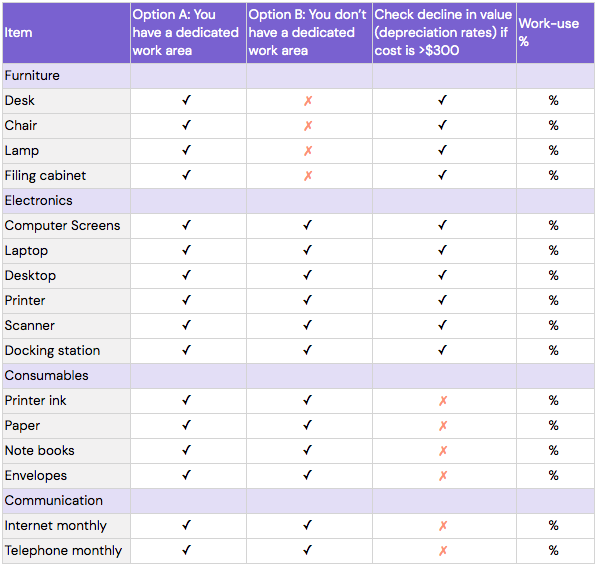

You cannot deduct commuting expenses for transportation between your home and your regular place of work. Deductions you can claim. Can you deduct work expenses in 2020.

You may be able to claim deductions for work-related expenses you incurred while performing your job as an employee. Thursday March 5th 2020. Employees guide for work expenses.

IRS Tax Tip 2020-98 August 6 2020. Based on the 80 cents per hour rule that would be a flat deduction of 5576 which would result in you reducing your tax bill by 181 on a 325 tax bracket. The vast majority of W-2 workers cant deduct unreimbursed employee expenses in 2020.

You cannot claim them personally. However when you are moving due to employment the employee is able to claim tax back through an employer. If so you may be wondering if youre allowed to take the home office tax deduction for those expenses on your 2020 federal tax return.

Using this shortcut method you can claim a tax deduction of 80 cents for each hour worked from home between March 1 and June 30. If you carry tools instruments or other items in your car to and from work you can deduct only the additional cost of transporting the items. However as we all know the concepts of fair and taxes do not always go hand in hand.

Employee business expenses can be deducted as an adjustment to income only for specific employment categories and eligible educators. Are unreimbursed employee expenses deductible in 2020. Moving home for a job raises the question are my moving costs tax-deductible the short answer is No.

Taxpayers can no longer claim unreimbursed employee expenses as miscellaneous itemized deductions unless they are a qualified employee or an eligible educator. With more people working from home than ever before some taxpayers may be wondering if they can claim a home office deduction when they file their 2020 tax return next year. If your EBE are reimbursed that reimbursement may or may not be taxable to you.

There are three ways you can choose to calculate your deduction for home office expenses shortcut method new due to COVID-19 fixed rate method. The method can be applied for work at home hours between 1 March and 30 June 2020. The home office deduction allows qualifying taxpayers to deduct certain home expenses on their tax return.

MyTax 2020 Claiming deductions. The Tax Cut and Jobs Act TCJA eliminated unreimbursed employee expense deductions for. Yes it doesnt seem fair that your employer can deduct the amounts they reimburse to you as a business expense but you as an employee cannot deduct those same expenses.

Alison Banney Updated Jul 17 2020.

Tax Time 2020 Special Home Office Expense Claim

Working From Home Tax Deductions Covid 19

Working From Home Tax Deductions Covid 19

How To Claim Working From Home Deductions Kearney Group

How To Claim Working From Home Deductions Kearney Group

Tidak ada komentar:

Posting Komentar