That includes sole proprietors and independent contractors. The rules vary for those who are employees employees who.

Claiming Home Office Expenses Tax Deduction Canadian Business Use Of Home

Deductible Office Expenses.

Can you write off home office expenses canada. You can also deduct expenses related to your home office. A taxpayers ability to deduct expenses for a personal workspace depends on whether the Canada Revenue Agency considers it. It is your principal place of business.

The amount you can claim for work-space-in-the-home expenses is limited to the amount of employment income that is left after you have deducted all other employment expenses. Use our Home office expenses calculator to help. The only people who can take the home office deduction are those who are self-employed according to Michael Corrente managing director of the tax group at CBIZ MHM an accounting and professional advisory firm.

Home Office Expenses - Examples. If your home is 1000 square feet and your home office measures 200 square feet youll be able to claim an amount equal to 20 2001000 20 of your related expenses on your return. If you work from a home office you will be eligible for deductions on certain home-office related expenses.

Expenses the CRA lets you deduct include pens pencils pencils paper clips stationery and stamps. The most common tax write-off for a small business in Canada is home-office expenses. How much you can write-off is determined by the percentage of your home office space compared to the total size of your home.

You use your home more than 50 of the time when you work. Such expenses cannot be claimed to create a business loss. Shortcut method An all-inclusive rate per work hour only available from 1 March 2020 to 30 June 2022.

The actual expenses you incur as a result of working from home. Self-employed individuals and qualified employees can claim expenses associated with having a home office. Dues Subscriptions Licenses Memberships - Examples.

Multiply the total cost of electric bills in the tax year by the percentage of your home used for business. Home office expenses are the most common tax-write offs for small businesses in Canada. If so you may be wondering if youre allowed to take the home office tax deduction for those expenses on your 2020 federal tax return.

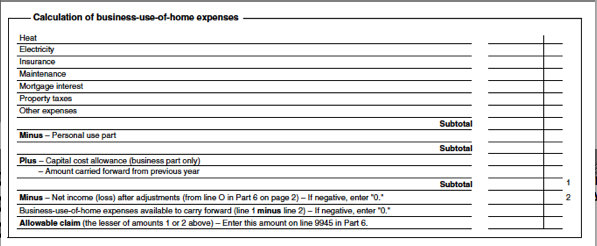

The Canada Revenue Agency allows you to deduct business-use-of-home or workspace-in-the-home expenses from your income lowering your taxable income and reducing your tax. The CRA considers these business uses of home expenses and allows you to deduct them from your income taxes The logic behind the deduction is that if you paid rent and common services in a commercial building you could obviously deduct the expenses. The short answer.

If youre in an industry in which you must pay professional dues or licensing costs in order to maintain your membership these are deductible. Yes you can write off electric bills for your home office. The short answer is.

These include expenses like. The good news is the Canada Revenue Agency allows you to deduct expenses relating to your home if you meet one of the following two conditions. Unfortunately there are certain expenses that a salaried employee cant claim on their return.

A lot of entrepreneurs conduct business at home. One often overlooked expense you can claim is cleaning services. This means that you cannot use work-space-in-the-home expenses to create or increase a loss from employment.

The Canada Revenue Agency CRA has stringent conditions that determine whether a home. If you work from home whether its in a big office or on the kitchen counter you can claim a large number of different expenses. You can deduct expenses for the business use of a work space in your home as long as you meet one of the following conditions.

You can deduct part of your home expenses such as utilities home insurance maintenance expenses. Utilities mortgage interest if owned rent it not owned repairs and maintenance property taxes insurance. When you run a home office the same principle applies but the calculations prove a bit more detailed.

If you are unable to claim any portion of home office expenses on your income tax return in the current year you can carry forward to future years to get deductions subject to fulfillment of business use criteria. If you have a cleaning lady tidy your home office you can claim that as. You cant write off a large portion of a very expensive all-in-one plan and you must be able to showhow the phone was used for your employment rather than for personal reasons.

The sorts of expenses you can claim for a home office depend on your work situation Dawson says. If you work from home you can write-off. Do not deduct calculators chairs desks and filing cabinets because these are capital expenses.

Home-office tax writeoffs can generate big savings. You can claim home office expenses against that particular business income which you operate from home office. You can deduct expenses for the business use of a workspace in your home as long as you meet one of the following conditions.

Mortgage interest on your residence. You use the space only to earn your business income and you use it on a regular and ongoing basis to meet your clients customers or patients. Calculate your work from home deduction.

Can I Deduct Home Office Expenses On My Tax Return Ig Wealth Management

Home Office Expense Costs That Reduce Your Taxes

What The Changes Are Home Office Expenses For Employees Canada Ca

21 Tax Write Offs For Small Businesses Tax Deductions Guide

21 Tax Write Offs For Small Businesses Tax Deductions Guide

Tidak ada komentar:

Posting Komentar