If so you may be wondering if youre allowed to take the home office tax deduction for those expenses on your 2020 federal tax return. Eligible employees working from home in 2020 due to the COVID-19 pandemic.

Working From Home Tax Deductions Covid 19

Practical information on how employees working from home during the COVID-19 emergency period can claim tax relief on home expenses.

Can you write off expenses for working from home during covid 19. Information making it clear employees cannot deduct any working from home COVID-19 expenses from income earned when working for an employer. Contact Us If you have a question about this topic you can contact the Citizens Information Phone Service on 0818 07. As part of the home office deduction you can write off some of your utility expenses taxes insurance repair and depreciation.

655 PM PST February 2. There is one small exception to keep in mind. If your employer requires you to work from home youve always been able to claim for increased costs eg heat or electricity for the specific time at home.

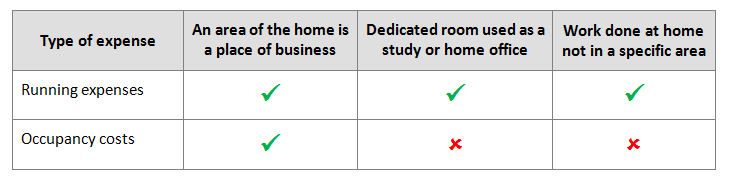

The home office is the place where the employee principally performed their employment duties. The short answer is. In this example the house is 100 square metres and the office 10 square metres 10 of the total area.

Apply for Wage Subsidy 8 from 9am 26 November to 1159pm on 9 December. Some people can deduct their business-related expenses and theres something called the home office deduction that lets you. If youre still going into an office three days a week and working from home twice a week it wont count.

While employees can no longer deduct their work at home expenses make sure you know how you might get reimbursed for these costs including as qualified disaster relief payments. Temporary flat rate method. If you worked more than 50 of the time from home for a period of at least four consecutive weeks in 2020 due to the COVID-19 pandemic you can claim 2 for each day you worked from home during that period.

Employer support during COVID-19 Link 5 If you employ people or are self-employed apply for COVID-19 support. This helps you pay wages for yourself and employees who cant come to work and cant work at home. There are two ways to figure out how much to deduct.

This method can only be. Even if you meet the two requirements above you still cant. You can claim 100 of expenses that are solely for business purposes eg a business phone line.

For instance unlike people on payroll they can write off some of the expenses associated with their residence. REUTERSEddie Keogh Before that employees could deduct unreimbursed business expenses along with other miscellaneous expenses which included home office costs if they totaled more than 2 of their unadjusted gross income. The maximum amount that can be claimed is 400 per individual.

For the rest you can claim the proportion of your house that you use for work. If youre a W-2 employee with a side hustle you can deduct eligible home office expenses for that particular side gig. Due to the coronavirus COVID-19 pandemic millions of employees who ordinarily work at an office or other workplace provided by their employers are now working at home.

That means the additional costs a person may have incurred due to working from home as well as other miscellaneous deductions that were subject to the 2 rule are not deductible in most cases. You can then also claim any additional days you worked at home in 2020 due to the COVID-19 pandemic. To ensure you can maximize possible deductions when completing your 2020 personal income tax return keep all of your receipts and invoices for purchases invoices for home expenses like heat hydro water internet etc.

David Gotfredson Investigative Producer Published. The tax overhaul suspended the business use of home deduction through 2025 for employees. If youre among the legions of workers who have joined the work-from-home movement during the coronavirus pandemic dont expect to write off associated costs on your 2020 taxes.

You can claim 2 for each day you worked from home in 2020 due to the COVID-19 pandemic up to a maximum of 400. Your employer is not required to complete and sign Form T2200. But the ability to write off home office expenses went away in 2018 for most W2 employees.

Keep in mind that this applies to employees and not to the self-employed Armstrong said. It got rid of the deduction for unreimbursed employee expenses which allowed remote workers to write off. Prior to the COVID-19 pandemic an employee could claim home office expenses if they were contractually required to maintain a home office they were not reimbursed for and met one of the following two conditions.

You cannot claim tax relief if you choose to work from home. And stay tuned to see what CRA releases in the coming months to address the fact that so many of us have been working from home during COVID-19. Yet during the 2020 lockdown HM Revenue Customs HMRC launched a microservice which even if you only needed to work from home for a day allowed you to get a WHOLE years tax relief.

This includes if you have to work from home because of coronavirus COVID-19. A woman working from her computer at home is seen as the spread of the coronavirus disease COVID-19 continues Oxford Britain March 31 2020. But heres the real kicker.

Although certain costs including the use of the home can be deducted as employee business expenses Ortiz Soto warned that the classification was severely restricted for. If youre self-employed you can still write-off. Well maybe you can.

You may be able to claim tax relief for.

Working From Home Due To Covid 19 It Could Boost Your Tax Refund

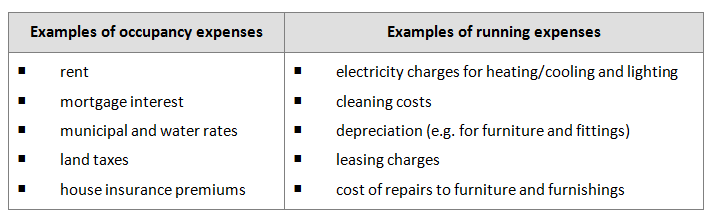

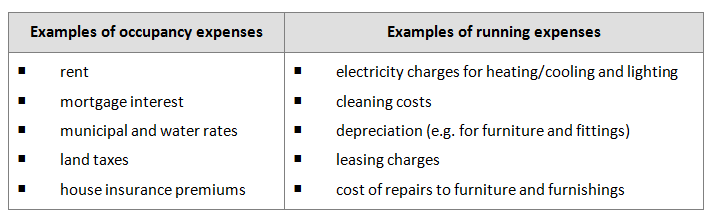

Claiming Expenses For Working From Home During Covid 19 Taxbanter

Working From Home Tax Deductions Covid 19

Claiming Expenses For Working From Home During Covid 19 Taxbanter

Working From Home During The Coronavirus Pandemic What You Need To Know

Tidak ada komentar:

Posting Komentar