Withdrawal of the pension contribution from the EPS Account is permissible only if you have not completed 10 years of service. Withdrawing PF balance plus EPS amount for below ten years of service If service period has been less than 10 years both PF balance and the EPS amount will be paid.

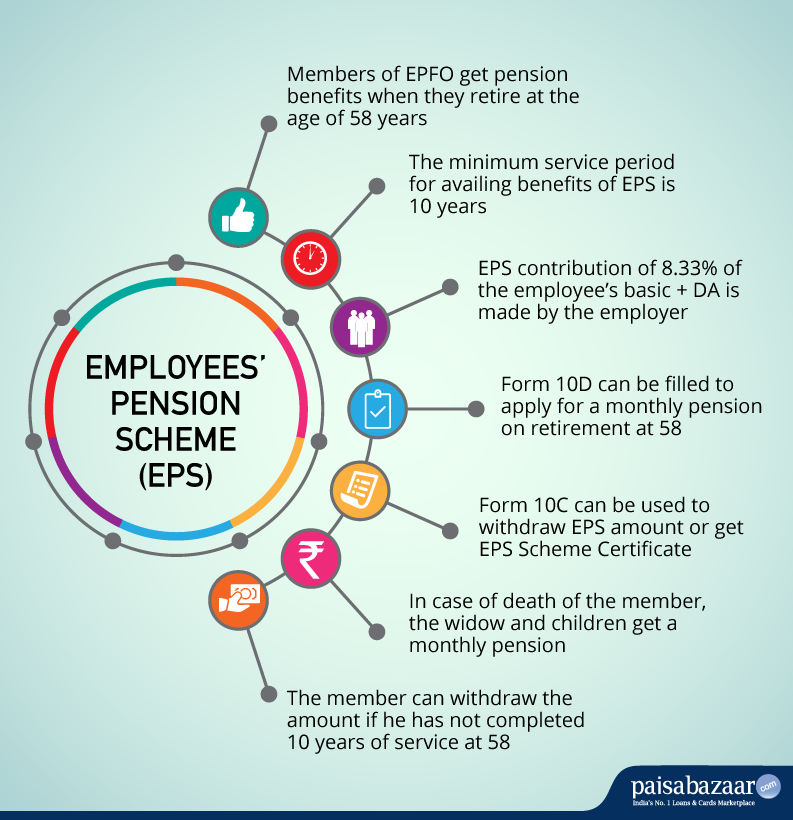

Eps Employee Pension Scheme Eligibility Calculation Withdrawal

If thats the case with you you can withdraw a one time amount from your EPS account.

Can i withdraw my pension contributions in pf account after 10 years. EPF members can withdraw this before 10yrs of service after 10 yrs they cant able to withdraw it. As per Voluntary Provident Fund withdrawal rules contribution to a VPF account is subject to a maturity period of 5 years. How Can I Know that My Pension Service Period Transferred or Not.

In the case of not taking the next job in India you can withdraw the EPF account balance after immediately resignation. Your pension provider sets a maximum amount you can take out every year. To get EPS amount in the Composite Claim Form Aadhaar or Non-Aadhaar along with choosing Final PF balance also choose the pension withdrawal option.

An employee can also withdraw 90 of the PF accumulation both employee and employer contribution after 54 years of age. Yes if he or she has retired after reaching the age of 58 years and between 01-04-93 and 15-11-95 the employee may join the new scheme after returning the withdrawal benefit plus interest. But the withdrawal must be made within one year of retirement superannuation whichever is later.

Read more about No pension withdrawal before 10 yrs on Business Standard. For home renovation one can make a partial withdrawal from his or her PF account. If you have worked for 10 years or more you would be given a pension certificate stating the amount of pension which you would compulsorily receive afte.

PF claim settled but money not credited. This limit will be reviewed every 3 years until you turn 75 then every year after that. Let me elaborate this- Actually I want to know that if an employee complete the 10 yrs duration of PF membership and after this particular duration if employee left the job then what will be the procedure to withdrawal the whole pf and pension fund at once.

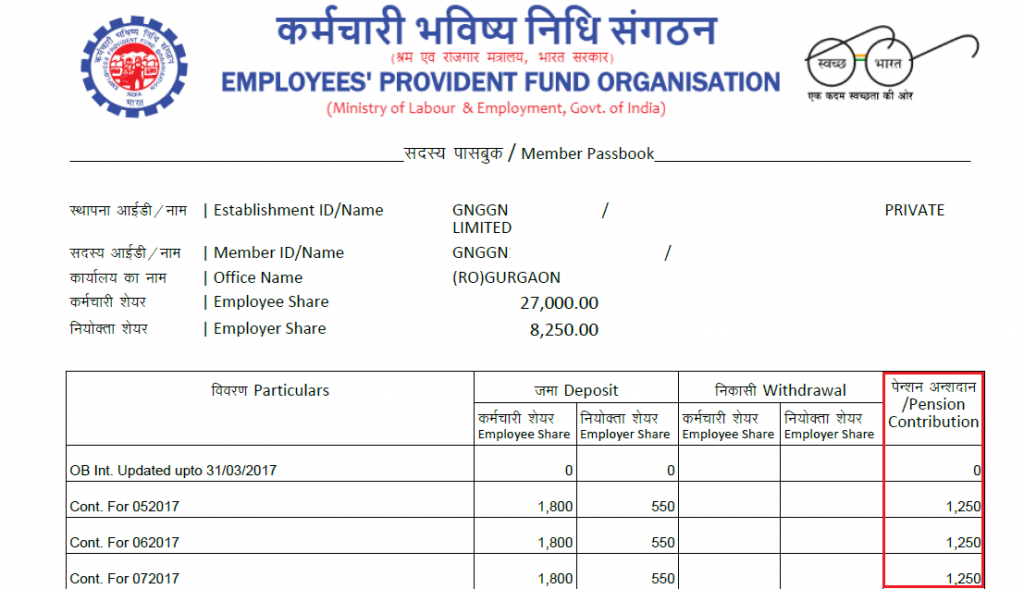

Now if subscribers decide to withdraw pension benefit on leaving employment before being eligible for the monthly. Right from month one of employment Pension Fund is made and is credited by 833 of contribution payable by the employer. However he can withdraw the Provident Fund at any time or when he leaves employment even before 58 years.

An EPF pension scheme member can withdraw early pension if he or she has attained the age of 50 but is less than 58 years old and if they have made an active pension contribution in EPF for 10 years or more. Pension Withdrawal Benefit Calculation. Before legislative amendments came along on March 1 2019 the pension fund withdrawal rules contained in the South African Pension Funds Act made it impossible to withdraw any part of a retirement benefit or borrow money from your retirement savings before the pensionable age of 55 depending on your unique.

PF Withdrawal after Leaving Job. When subscribers reach the age of 58 years and they have served for at least 10 years they are eligible for pension benefits. That is the employees share of 12 will go to Provident.

Withdraw cash from your pension pot. You can avail this facility twice once five years after the completion of the house and then 10 years after the completion of the house. Therefore an individual cannot withdraw any sum from their Voluntary Provident Fund before.

Answer 1 of 5. Respected All I would like to request to all of you to impart the directives information about the pf withdrawal. Either they have to wait until 58yrs of age or they can get a scheme certificate.

There is generally a 2 month waiting period after resignation after which you can opt to withdraw your PF money. You can withdraw full EPF corpus amount after leaving the job or being unemployed for minimum 2. An EPS scheme certificate is issued which can be used to fill Form 10D for monthly pension withdrawals.

20000 in the fund inclusive of interest. Can I withdraw money from my pension before the age of 55. Can a 58 year old Family Pension Scheme Member who has retired on 15-01-94 avail pension under the new scheme.

Pension withdrawal benefit is only available to those who havent yet completed 9 years and 6 months of service in total. Some of his corpus amount would have been in the EPF account till 2038 his age would be 57 years. In such cases the pension value is reduced to a rate of 4 per year until the employee reaches the age of 58 years.

You cannot apply for withdrawal of EPF account balance immediately after your resignation from a company. EPS Pension Formula. Along with EPF there are funds in the EPS which the employee can either withdraw or carry-over to the new employer using the scheme certificate.

Facing a Rs 19291-crore deficit in the Employees Pension Scheme EPS 1995 the government plans to stop members from withdrawing from the scheme until they complete 10 years of service. But If the employee would have left the job after 10 Feb 2016 he couldnt get 100 EPF corpus amount. This means that if you retire at.

Home loan If you have been in service for 10 years you can withdraw up to 90 of the entire EPF balance employer and employee contributions included for a home loan provided there is at least Rs. The compounding effect can be visualized in a way that if a member does not withdraw his PF money on change of job and gets it transferred to his new account then the same money would get doubled in approximately 8 years assuming EPFO continues to give at least 85 interest rate just like it has given in the past so many years. According to a Bengaluru bench of the Income-Tax Appellate Tribunal ITAT ruling the interest credited to an Employees Provident Fund EPF account after an individual ceases to be in employment is taxable in his hands in the year of credit.

The withdrawal conditions are. However during the period when contributions dont get credited to the PF account the interest rate earned does not remain tax-free. VPF Rules and Guidelines Taxation.

There is no such transfer of PF to Pension after 10 years. You should have completed a.

Can I Withdraw My Pension Contributions In Pf Account While Working Before 10 Yrs After 10 Yrs

What Is Employees Pension Scheme Eps Eligibility Calculation Formula

What Is Employees Pension Scheme Eps Eligibility Calculation Formula

How To Withdraw Pension Contribution In Epf After Leaving The Job Abc Of Money

Eps Employee Pension Scheme Eps Eligibility Calculation Formula

Tidak ada komentar:

Posting Komentar