If your per diem is included in your wages you can enter that amount and deduct it. They can just simply reflect the relevant portion of home office expenses within the Local Business Trade and Professional Income section of their ITR12.

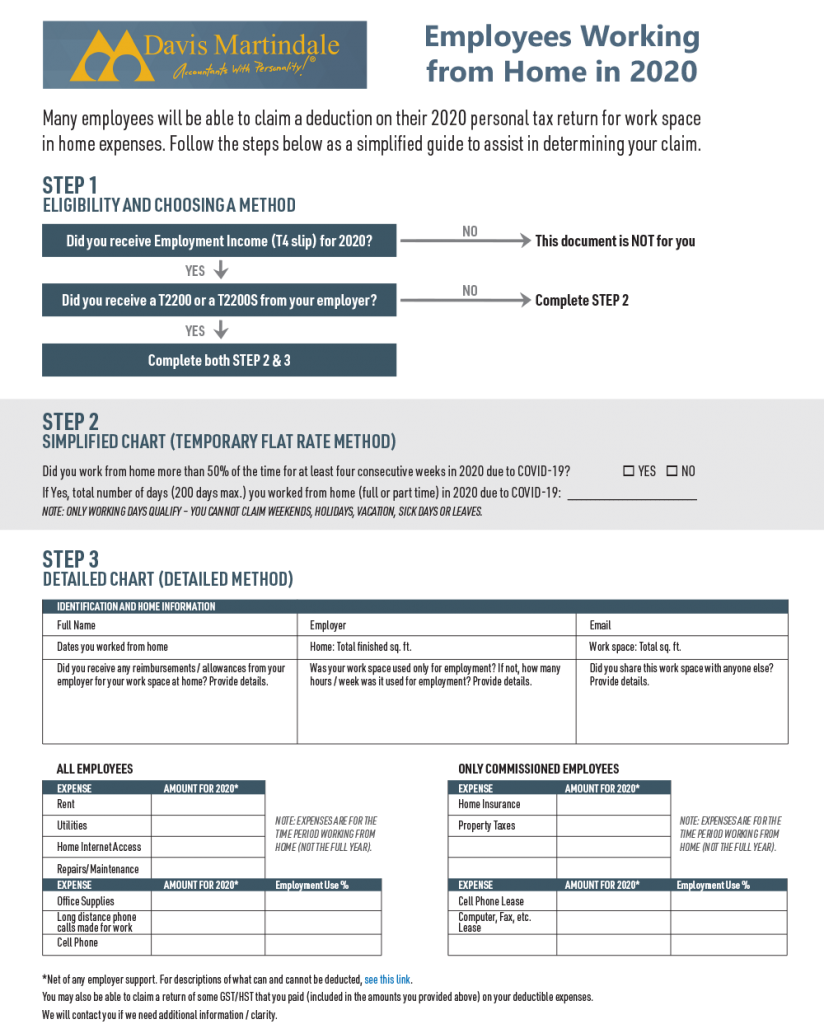

Employees Working From Home In 2020 Davis Martindale

For instance you may not take the home office deduction if you regularly trade stocks online.

Can you write off expenses for working from home in 2020. This is whats required in order to deduct home office expenditure. With more people working from home than ever before some taxpayers may be wondering if they can claim a home office deduction when they file their 2020 tax return next year. Here are some things to help taxpayers understand the home.

Jason is an employee who works for a Manhattan law firm. SAN DIEGO Many people are working from home during these pandemic times. Depending on what your per diem covers there may be additional out-of-pocket costs that you can deduct.

You can also claim 30 of broadband costs for the tax year 2020. If you meet the eligibility criteria you can claim a portion of certain expenses related to the use of a work space in your home. To qualify for either method of calculating the deduction the.

If it is not reported as wages to you you cannot deduct the cost. 6 a week from 6 April 2020 for previous tax years the rate is 4 a week - you will not need to keep evidence of your extra costs. You can either claim tax relief on.

The exact amount of extra. The home office deduction allows qualifying taxpayers to deduct certain home expenses on their tax return. Some people can deduct their business-related expenses and theres something called the home office deduction that lets you.

Its a good idea to keep a record of any expenses you want to write off when working from home until the end of the year and file them safely in case of future external audits by the HMRC. The employer must allow the taxpayer to work from home. There are two ways to figure out how much to deduct.

What Remote Workers Need to Know Before Filing for 2020 If youve been working from home in 2020 there are a few things you should know about tax deductions. You can only claim for the days that you work from home. You can deduct 5 per square foot up to 300 square feet of the portion of your home thats used for business.

Due to the coronavirus COVID-19 pandemic millions of employees who ordinarily work at an office or other workplace provided by their employers are now working at homeWhile you can no longer get a tax deduction for work at home expenses here are some other ways you can get reimbursed for these costs including as qualified disaster relief payments. You can either provide the total expenses or list a detailed break-down of expenses. Limited companies generally fill out a company tax return.

Well maybe you can. Employees who are still working from their couches cant take a write-off on their 2020 federal return yet a handful of states will allow you a tax deduction for costs employers wont reimburse. Can I deduct living expenses when I work away from home.

Indirect expenses include rent home mortgage interest and taxes if you own your home utilities depreciation and other costs of maintaining your home. This applies for the duration of the COVID-19 pandemic. As part of the home office deduction you can write off some of your utility expenses taxes insurance repair and depreciation.

But does that mean you can write off your home office expenses for the 2020 tax year. There are a few basic criteria for determining whether you can write off work-from-home expenses on your tax return. If you use your internet 20 of the time for work you can deduct that percentage of your total internet bill.

Home Office Tax Deduction. You can then also claim any additional days you worked at. IRS Tax Tip 2020-98 August 6 2020.

This does not include times you may have brought work home to do outside your normal working hours. As part of the home office deduction you can write off some of your utility expenses taxes insurance repair and depreciation. This method simplifies your claim for home office expenses work-space-in-the-home expenses and office supply and phone expensesIf you worked more than 50 of the time from home for a period of at least four consecutive weeks in 2020 due to the COVID-19 pandemic you can claim 2 for each day you worked from home during that period.

For example if you use 10 of your home for your office you may deduct 10 of these expenses. These include rent mortgage interest real estate taxes homeowners. There are two ways to figure out how much to deduct.

Commission employees who sell goods or negotiate contracts typically have an income amount in box 42 on their T4 slip can claim some expenses that salaried employees cannot. Please see letter from employer which is required. Home-office expenses eligible for a California tax write-off can include desks and chairs as well as a portion of your rent utilities homeowners insurance or renters insurance and repair.

Working From Home Tax Deductions Covid 19

Working From Home Tax Deductions Covid 19

What The Changes Are Home Office Expenses For Employees Canada Ca

Home Office In Germany Five Tips For Smart Savers

Can I Write Off Home Office Expenses During The Pandemic Cbs8 Com

Tidak ada komentar:

Posting Komentar