You can deduct mileage related to work 565 cents per mile in 2013 or you can add up all the actual automobile expenses then multiple it by your business percentage business milestotal miles for the year but you cant do both. Heres how it works.

How To Claim Your Work Related Car Expenses In 2020 Gofar

There are two types of car expense write-offs.

Can you write off job expenses. Keeper Tax automatically finds tax deductions among your purchases. You can take this write off even when you dont itemize. The job search must be in the same line of work as your current or most recent job and you can deduct things like transportation preparing printing and mailing your resume and employment agency fee.

This wasnt the most generous deduction in the worldsuch expenses were deductible only if and to the extent they exceeded 2 of an employees adjusted gross income. Expenses relating to earning income that is not assessable such as money you earn from a hobby. Itemizing your deductions is the process of taking approved expenses off the taxes you owe to reduce your tax burden.

The good news is you can sometimes get a tax deduction for certain job search expenses. If you do a lot of public speaking over the course of your freelance work an improv class can help you loosen up and feel more comfortable on the job. You list the employee expenses on Form 2106.

Job expenses are claimed a miscellaneous deduction on IRS Schedule A Itemized Deductions. As a rule of thumb all travel-related expenses on a business trip are tax-deductible. Thankfully for tax years 2017 and prior the IRS allows you to deduct certain unreimbursed job-related expenses that you incur in the course of your work.

Additionally the following are job-related expenses that were non-deductible in past years and will remain non-deductible for 2021. Starting in 2013 the IRS offers you a new simplified method for computing your home office deduction at 5 a square foot. Here are some common travel-related write-offs you can take.

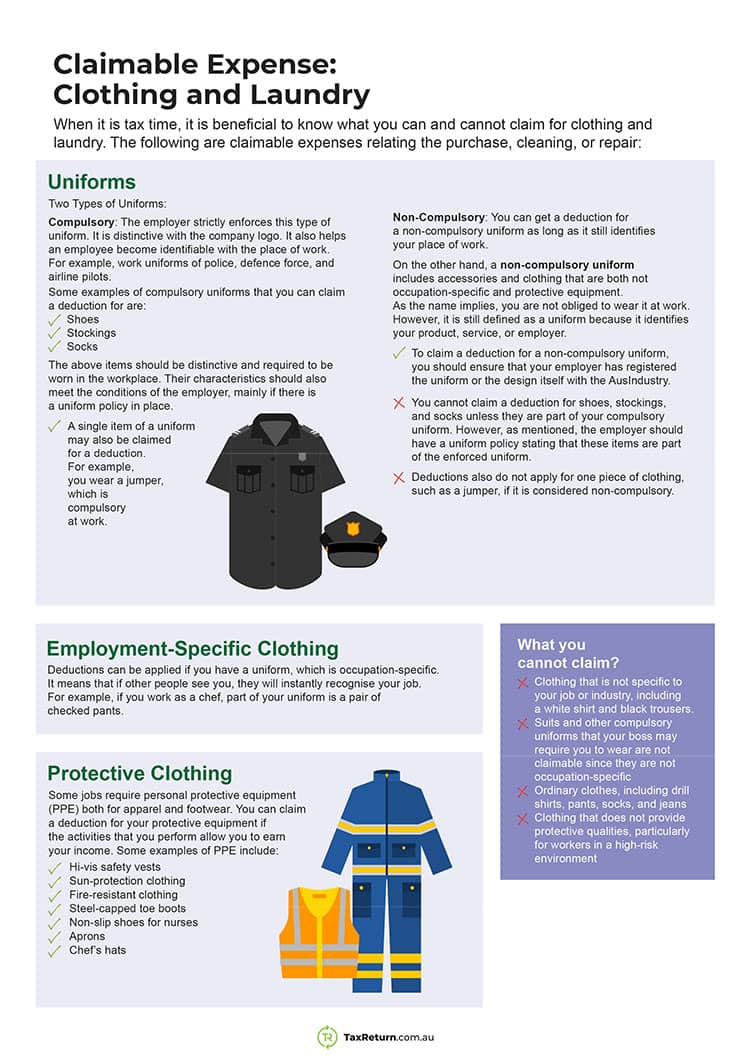

You can deduct certain expenses you have paid in looking for a new job in your present occupation even if you do not get a new job. You cant deduct job-search expenses for your first job or for a job in another line of work. This can be a grey area but here are some clothing expenses that can be deducted under the right circumstances.

The travel expenses you can write off. Employer reimbursement for your relocation expenses cannot also be deducted from your taxes unless the reimbursement is added to your taxable gross salary. There are some expenses that are not deductible such as.

To take the deduction your overall miscellaneous deductions including job search expenses must add up to more than 2 percent of your Adjusted Gross Income --. On average people discover write-offs worth 1249 in 90 seconds. If you carry tools instruments or other items in your car to and from work you can deduct only the additional cost of transporting the items.

What you cant claim. You can write off the cost of printing your resumes and postage as well as the cost of advertising or using an. The basic rule of this deduction is that if the uniform or clothing could be worn outside of work then you shouldnt deduct it.

You must also meet whats called the 2 floor That is the total of the expenses you deduct must be greater than 2 of your adjusted gross income and you can deduct only the expenses over that amount. All miscellaneous deductions combined must total at least 2 percent. Another tax break for your educational expenses.

What can you deduct. Searching for a job sucks so take some comfort in the fact that you might be able to write off some of the expense. If you keep meticulous records of your expenses youre able to write off several things you need for waiting tables that could result in a lower tax bill or even a refund at tax time.

Job-related expenses for employees are no longer deductible on most peoples federal return in tax years 2018 through 2025 due to the Tax Cuts and Jobs Act TCJA that Congress passed and the President signed into law on December 22 2017. If youre eligible to deduct your W-2 job expenses heres what you can write off. If You Pay Job Expenses Yourself Prior to the passage of the Tax Cuts and Jobs Act employees were able to deduct unreimbursed job expenses as a personal itemized deduction.

Expenses you can only deduct with the actual expense method and expenses you can deduct with both methods. The expenses must be ordinary and necessary. You can also claim meals while traveling but be careful with entertainment expenses like going out for drinks.

Private or domestic expenses such as childcare fees or clothes for your family. As a reminder you can deduct any ordinary or necessary expense required for your field of trade business or profession. You cannot deduct the job search expenses if you are looking for a job in a new occupation there was a substantial break between the ending of your last job and you are looking for a new one or you are looking for a job for the first time.

To deduct workplace expenses your total itemized deductions must exceed the standard deduction. This write-off is considered a miscellaneous itemized deduction like employee business expenses and. You cant always claim your education expenses as a business deduction.

To qualify you have to have looked for work in the same field as your most recent job so you cant claim this deduction if you were looking for your first job. You are allowed to take the deductions if you intend to fulfill the required 39 weeks of work in your new location. That means you can deduct the class from your tax bill.

You cannot deduct commuting expenses for transportation between your home and your regular place of work. Professional dues or subscriptions. But theres another tax break you might be able to claim.

The GST component of a purchase if you can claim. However the job-related expenses deduction is still available to people who work in one of these specific. The importance of the 2 floor.

To write off a work expense as an employee you must itemize deductions on Schedule A of your Form 1040. If you applied for jobs in 2014 you may be able to deduct your job hunting expenses even if you didnt end up landing a new job. Uniform or special clothing.

Tax Deductions For Tradies Give Your Refund A Boost

Teacher Tax Deductions Great Ways To Boost Your Tax Refund

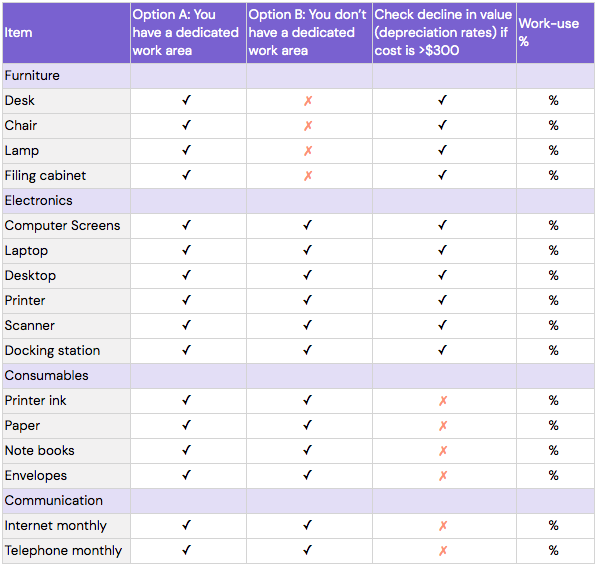

How To Claim Working From Home Deductions Kearney Group

Claimable Expenses What You Can Claim On Your Tax Return

Working From Home Tax Deductions Covid 19

Tidak ada komentar:

Posting Komentar