These can be additional running expenses such as electricity the decline in value of equipment or furniture and phone and internet expenses. Write COVID-19 hourly tax rate in your tax return.

Working From Home Tax Deductions Covid 19

You cant claim a deduction for the following expenses if youre an employee working at home.

Can you deduct home office expenses if you work from home. Provided that you meet the requirements as set out in the Income Tax Act section 11a read in conjunction with sections. If so you may be wondering if youre allowed to take the home office tax deduction for those expenses on your 2020 federal tax return. If you work full-time for someone else youre out of luck.

To work out how much you can claim you need to work out what percentage of your entire home is taken up by your home office. The allowable deduction for each appliance should be calculated as follows. Available if you work in a room alone or use a separate home office room.

If so you may be wondering if youre allowed to take the home office tax deduction for those expenses on your 2020 federal tax return. With this method you deduct your actual expenses. You may also claim tax deductions for work-related expenses specifically related to your occupation and industry.

Capital expenses such as machinery and equipment over a longer period. They include mortgage interest insurance utilities repairs maintenance depreciation and rent. You can find out more about course expenses you can claim at the ATO website.

Employees are not eligible to claim the home office deduction. You can use a fixed rate of 52 cents per hour for home office expenses for heating cooling lighting and the decline in value of furniture instead of keeping details of actual costs. Operating expenses such as office stationery and wages in the year you incur them.

This means a deduction is. The space must also be either where she principally more than 50 per cent of the time performs her duties of employment or be used exclusively to meet customers on a regular and. The costs of repairs to your home office equipment.

If your studies were work-related and you enrolled in an eligible course you may be able to claim a tax deduction. Generally you can claim. The type of expense operating expense or capital expense determines when you can claim your deduction.

According to the Australian Taxation Office here are some of the things you can claim when working from home. Your employer is not required to complete and sign Form T2200. You can claim 2 for each day you worked from home in 2020 due to the COVID-19 pandemic up to a maximum of 400.

For example if your home office is 10 of your entire living space you can deduct that much from the costs of mortgage rent. There are certain expenses taxpayers can deduct. Employees who receive a paycheck or a W-2 exclusively from an employer are not eligible for the deduction even if.

In addition if your employer does not provide you with a workspace and you can provide evidence that your home is your primary place of work you can occupancy expenses as well. If youre an employee who works from home you may be able to claim a deduction for expenses you incur relating to that work. You can deduct 100 of some of your home office expenses such as the cost to paint or make repairs to that specific area.

For example if your home office is. There are 2 other ways you can work out deductions for working. Write the deduction amount in your tax return in the Other work-related expenses section.

Taxpayers must meet specific requirements to claim home expenses as. The short answer is probably not. The Standard Option.

Coffee tea milk and other general household items your employer may provide at work. Keep a record of how many hours you worked from home. So if your home office takes up 15 of your home you can claim 15 of.

When you can claim your deduction. You need to work out the numbers for you. Equipment you buy for your childrens education.

Eligible employees working from home in 2020 due to the COVID-19 pandemic. You can also deduct a portion of other expenses including utilities based on the size of your office versus your home. However if you set up your home office in a room that is shared or has a dual purpose such as a living or dining room you can only claim the expenses for the hours you had exclusive use of the area.

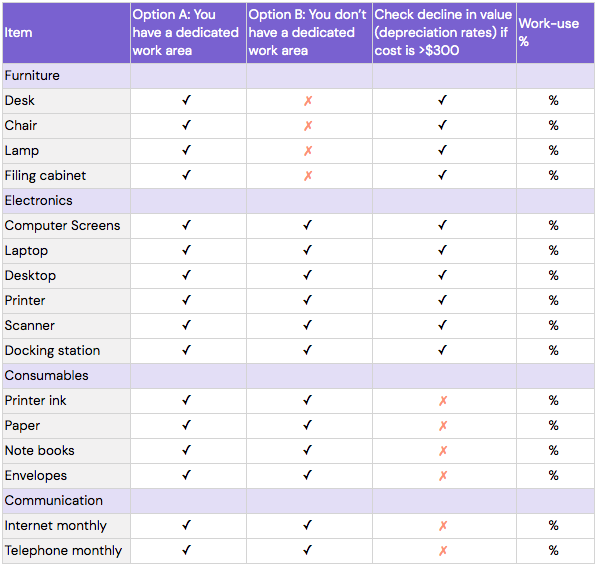

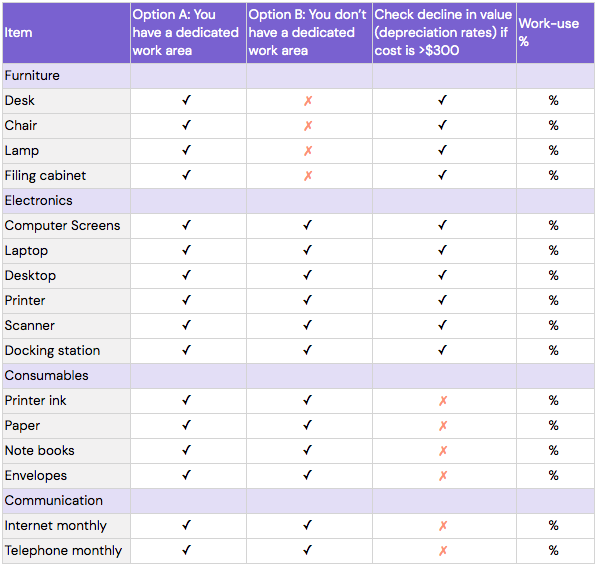

Home office equipment like computers printers and furniture the full cost of these items up to 300 and depreciation of items up to 300 Heating cooling and lighting costs. If you work from home either part time or full time then some portion of the home office expenses may be claimed as a tax deduction. If you are an employee who works from home and has set aside a room to be occupied for the purpose of trade you may be allowed to deduct certain expenses incurred in maintaining a home office which will be calculated on a pro-rata basis.

Work out your deduction amount. You can deduct the additional power costs you incur exclusively as a result of working from home. You just need to keep a record of the number of hours you use the.

Expenses you cant claim. To be entitled to deduct home-office expenses an employee must be required by the contract of employment to maintain such an office as certified by the employer on the T2200. If so you may be wondering if youre allowed to take the home office tax deduction for those expenses on your 2020 federal tax return.

You can also deduct a portion of other expenses including utilities based on the size of your office versus your home. Occupancy expenses such as mortgage interest or rent council rates land taxes house insurance premiums. The home office deduction Form 8829 is available to both homeowners and renters.

Not available if you work in the living room while family members watch TV. If you operate some or all of your business from your home you may be able to claim tax deductions for home-based business expenses in the following categories.

Home Office Expenses Claim July 2014

How To Claim Working From Home Deductions Kearney Group

Home Office Expenses The Essential Guide Box Advisory Services

6 Working From Home Deductions You Can Claim Box Advisory Services

Home Office Work From Home Tax Deductions Societyone

Tidak ada komentar:

Posting Komentar