If it is not reported as wages to you you cannot deduct the cost. But there are certainly other expenses that can also be included as claimable expenses under the Living Away from Home Allowance.

How To Claim The Living Away From Home Allowance Universal Taxation

If a business expense has incidental private benefit it may still be deductible.

Claiming expenses for working away from home. As a contractor you may be eligible for LAFHA Living Away From Home Allowance. Meals if you are away overnight. Travel from your workplace to offsite meetings or events.

The journey must take the employee away from their usual place of work for 5 hours or more. Both the lower and upper tax tribunals disagreed with HMRC in a recent tax case. The main stipulations required to claim meal expenses are.

Train tram bus taxi or ride-sourcing fares. You cant deduct expenses that are lavish or extravagant or that are for personal purposes. Vehicles you use for work.

Car hire fees and the costs you incur such as fuel tolls and car parking when using a hire car for business purposes. Transport costs are one of the most popular travel tax deductions. Some expenses are listed below.

Contractors who have limited companies should only deduct receipted food expenses. Generally work related travel in your car or on public transport is claimable with the exception of travel from home to work and vice versa. For the rest you can claim the proportion of your house that you use for work.

Ie you could claim for a sandwich but not for. The absence of hard and fast rules can make claiming travel expenses difficult as often the deductibility of such costs can be dependent on the nature of employment the amount of time spent away from home and whether an allowance has been received to. Or when staying away from home overnight.

Working from home Uniforms work clothing and tools. Examples include newspapers laundry. Travel between two separate workplaces or jobs.

Provided the visit qualifies you can reimburse employees for meals hotel accommodation and some incidental expenses incurred when they are working away from home and their regular workplace. Expenses for accommodation meal and incidental expenses are not deductible unless the employee is required to work away from home. This means that the lifestyle benefits of working from home together with the need to remain vigilant due to COVID-19 have become game-changers leading to more people working from home and claiming expenses.

You can claim for a meal allowance or actual meal costs whilst you are working at a remote site away from your normal place of work. Expenses you can claim include. The time spent working away from home.

In this example the house is 100 square. If you are working at a temporary workplace ie you will move to another place before 2 years you can claim for subsistance whilst away from home. Accommodation at the permanent or primary location for up to 21 days.

If your per diem is included in your wages you can enter that amount and deduct it. LAFHA is an allowance that reduces your taxable income to assist with food rent and other removal costs Call Us. Its slightly more complicated than this though as you can claim for preprepared food like a meal out or a sandwich but you cant claim for food you are going to prepare yourself.

Can I deduct living expenses when I work away from home. If your home is indeed your place of work and you have an area set aside exclusively for work activities you may be able to claim both occupancy and running expenses. Professional fees and subscriptions.

If you use your home for business whether youre a contractor sole trader in partnership or own a company you can claim a portion of household expenses. You can claim 100 of expenses that are solely for business purposes eg a business phone line. The cost of food or drink must be incurred after the business trip has started.

If as is more typical you carry on your work or business elsewhere at an office perhaps but do some work at home occasionally you cannot claim occupancy expenses even if you have a home work area set. Travel and overnight expenses. The employee has a permanent home elsewhere.

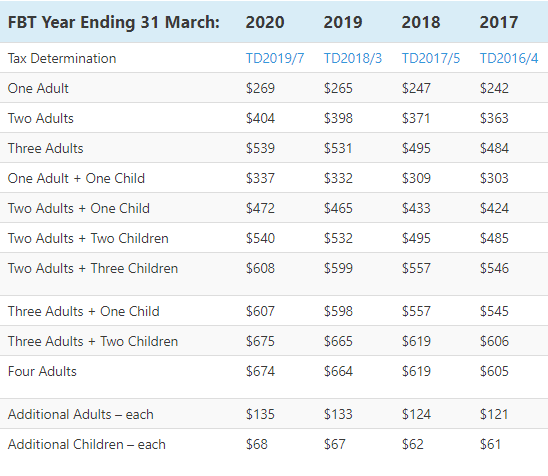

HMRC thinks that self-employed people renting property on longer-term assignments away from home should not be able to claim tax relief for their accommodation expenditure. To help you calculate working away from home allowances HMRC has published benchmark scale rates that set out recommended figures for different types of. In determining whether an employee is living away from home regard should be had to various key factors.

LAFHAs can also be payments to compensate you for other disadvantages such as isolation. The work requires the employee to sleep away from home overnight. The trip must be outwith their usual commute and be done as part of their job.

To be allowable a meal allowance has to be an expense of travel. Employees staying away from home overnight on business often incur additional expenses of a personal nature. The employee does not incur the expenses in the course of relocating or living away from home.

Required to Sleep Away from Home When an employee is required to sleep away from home the accommodation meal and incidental expenses that would normally be private in nature have an employment- related character. Youre traveling away from home if your duties require you to be away from the general area of your tax home for a period substantially longer than an ordinary days work and you need to get sleep or rest to meet the demands of your work while away. These expenses include such costs as accommodation and meals.

Individual living and working away from home can claim for expenses fooddrink and accommodation. A Living Away From Home Allowance is intended to compensate you for expenses incurred whilst you are working away on secondment or on a contract. An area where we see individuals getting it wrong as employees is in relation to claiming work-related travel expenses.

Changing patterns of working from home are also starting to become desirable with staff reluctant to return to the office 2. Depending on what your per diem covers there may be additional out-of-pocket costs that you can deduct.

Home Office Work From Home Tax Deductions Societyone

Home Office Expenses Claim July 2014

Work Related Travel Expenses Online Tax Australia

How To Claim The Living Away From Home Allowance Universal Taxation

Tax Deductions For Tradies Give Your Refund A Boost

Tidak ada komentar:

Posting Komentar