Unfortunately you cant just jump on the next plane to the Bahamas and write the trip off as one giant business expense. Now we just did an entire episode last week on avoiding investment fees and expenses so this shouldnt be much of a write off for any of you.

/deducting-business-meals-and-entertainment-expenses-398956-Final-3fbab40ad9ae4a998a2e21137ecfa5ea.png)

Deducting Meals As Business Expenses

However you must be able to prove that the reason for the trip was professional in nature.

/deducting-business-meals-and-entertainment-expenses-398956-Final-3fbab40ad9ae4a998a2e21137ecfa5ea.png)

Can you write off work expenses 2019. If so then you could deduct various costs as theyd be considered business expensesWhen you file your tax return youd fill out an extra form called Schedule C where you can report expenses for travel equipment uniforms cell phone service insurance fees and. You can do this only if your employment contract required you to pay the expenses and you did not receive an allowance for them or the allowance you received is included in your income. In order to be deductible employee expenses must exceed 2 percent of your adjusted gross income as figured on your Form 1040.

You need to leave your tax home. Additionally you can deduct the cost of baggage passport application laundry phone calls and tips. Like all deductible expenses the item needs to be ordinary and necessary for your business operations.

Uniform or special clothing. At first glance your modeling career may seem to be all expenses when tax season comes around but here are some tax write-offs you may not have thought off. Heres how to make sure your travel qualifies as a business trip.

Under the 2 rule youre only allowed to deduct the portion of total miscellaneous expenses that exceed 2 of your adjusted gross income AGI. Self-employed people can effectively write-off all commuting but you need to keep strict records. This is because they are subject to a 2 floor.

However the type of trips you can include also depends on where you claim your office is. In 2019 things change if youre self-employed. You can deduct taxi fares airfares and train tickets.

Perhaps you work as an employed officer but have a side gig in the field where youre a 1099 worker. But if you have unreimbursed business expenses as an employee what used to be known as Employee Business Expenses EBE then those expenses are generally no longer deductible for the 2019 tax year on your federal tax return. Other expenses required for your field of work or occupation.

Depreciation of vehicles or work-related assets. To be able to write off the cost of a work-related trip expenses the trip must last one year or less. You must also meet whats called the 2 floor That is the total of the expenses you deduct must be greater than 2 of your adjusted gross income and you can deduct only the expenses over that amount.

To write off travel expenses the IRS requires that the primary purpose of the trip needs to be for business purposes. Yes you can deduct per diem or actual job related expenses like meals lodging air fare cabs dry cleaning etc if your assignment away from your main workplace is temporary expected to last and does last for one year or less. However as a W2 employee they are difficult to actually deduct from your taxes and thus see any tax benefit.

You can either deduct a portion of your actual driving expenses based on your work-related mileage or you can use the standard mileage rate set by the IRS each year. Write off in-house expenses. That means you can only write off the cost of.

In fact they were not deductible in 2018 and will not be deductible through 2025. But if you have unreimbursed business expenses as an employee what used to be known as Employee Business Expenses EBE then those expenses are generally no longer deductible for the 2019 tax year on your federal tax return. To deduct workplace expenses your total itemized deductions must exceed the standard deduction.

Professional dues or subscriptions. Plenty of freelancers work in-house several or dozens of hours a week. Can you write off work expenses 2019.

If youre eligible to deduct your W-2 job expenses heres what you can write off. The gig economy is. The attire should be in line with industry standards ordinary and it should be essential in order to run the business necessary.

You can deduct certain expenses including any GSTHST you paid to earn employment income. The 2 Percent Rule. The importance of the 2 floor.

Never the less you can write off things like investment counseling fees custodial fees your safety deposit box transportation fees to and from an appointment at your financial advisors office attorneys fees paid to collect taxable. For an item of clothing to qualify as a business expense it needs to meet certain IRS criteria. Deducting work clothing.

Models can be considered both as runway or in person modeling as well as brand-promotion models at trades fairs and individuals being featured in photo shoots or short films. The rate was 535 cents per mile in 2017 545 cents per mile in 2018 58 cents per mile in 2019 and 575 cents per mile in 2020.

Work From Home Deductions And Expenses Can You Claim In 2021

How To Claim Tax Deductions Without Receipts Tax Tips Blog

How To Claim Your Work Related Car Expenses In 2020 Gofar

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

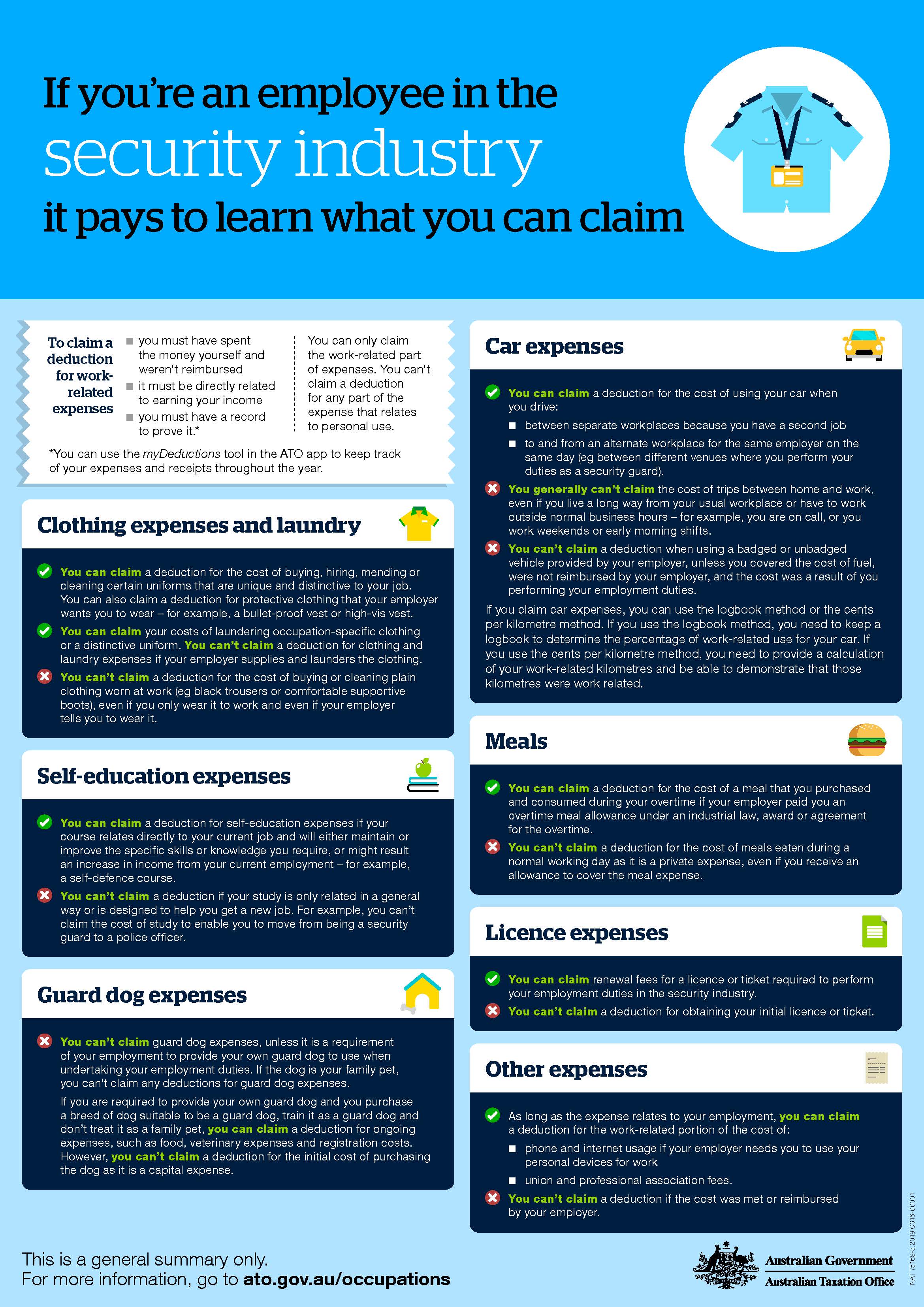

Ato Tax Deduction Information For Security Workers Spaal

Tidak ada komentar:

Posting Komentar