You may also be qualified to deduct home office expenses if you use the home office space to meet or deal with patients customers or clients even if it isnt your primary place of business. Your deduction limit is 2000 but you have 4000 in home office expenses that you still want to deduct.

The Approach To Tax When You Re Working From Home Gfa Accountants

The TCJA did not change the.

Can you write off home office expenses in 2019. According to IRS home office rules home office expenses can only be deducted when you regularly and exclusively use a specific part of your home as your primary place of business. A desk chairs lamps and other home office necessities are all tax write offs. You need internet to do your job.

In order to get the largest home office deduction youll likely have to use both methods to find which deduction is larger. For example if your home is 1500 square meters and your office is 300 square meters your office is 20 of your homes total size which means you are able to deduct 20 of many home expenses as home office expenses on your tax return. Remember your deduction cant exceed the gross income from the business use of your home.

If youve been locked-down working from home due to COVID-19 youll only be able to claim a home office deduction if you end up working from home for more than six months of the tax year provided you have an area of your home exclusively used and set up for this purpose. Whether rental or homeowner insurance you can write off a portion as part of home office. They include mortgage interest insurance utilities repairs maintenance depreciation and rent.

You cant claim occupancy expenses. There are certain expenses taxpayers can deduct. The home office deduction Form 8829 is available to both homeowners and renters.

How much is the home office deduction worth in 2019. The short answer. In general deducting the actual expenses will get you a larger write-off.

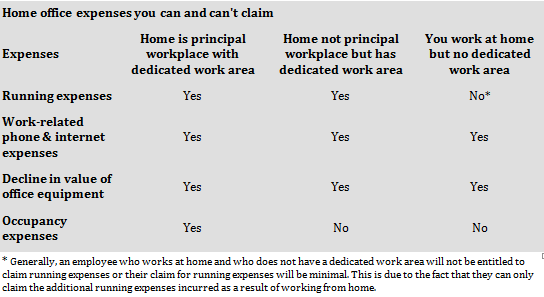

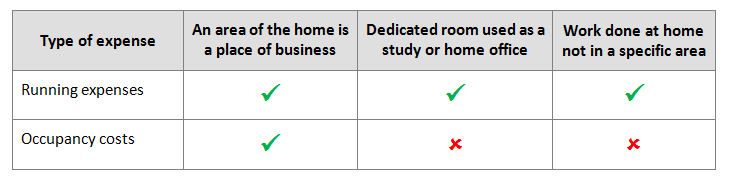

If you are an employee receiving a W-2 then you cannot claim home office expenses even if you have no other location from which you can work. That includes sole proprietors and independent contractors. You can only claim occupancy expenses if you can show that.

Your comcast bill is a tax write off. Enter HOME OFFICE and then the amount. You can enter your home office expenses on Form 2106 Employee Business Expense.

I have a 10x10 bed room dedicated as a HOME OFFICE and 10x20 area in my. There are recent changes to claiming your tax deductions. The only people who can take the home office deduction are those who are self-employed according to Michael Corrente managing director of the tax group at CBIZ MHM an accounting and professional advisory firm.

It is simply not allowed on the 2019 Federal tax return if you are an employee. There will be no capital gains tax CGT implications for your home. Get the biggest tax write off for your home office.

Thanks to your home office you also qualify to deduct a percentage of other expenses such as utilities rent homeowners insurance property taxes and mortgage interest. To determine how much you can deduct for your home office expenses calculate the size of your office as a percentage of your homes total size. For a summary of this content in poster format see Home-based business expenses PDF 456KB This link will download a file.

You can therefore only deduct up to the 2000 deduction limit and will have to carry over 2000 4000-2000 to the next tax year. Eligible employees working from home in 2020 due to the COVID-19 pandemic. As an employee working from home generally.

As a result of the TCJA for the tax years 2018 through 2025 you cannot deduct home office expenses if you are an employee. You can deduct rent or mortgage payments utility bills property taxes insurance and any expenses to repair or improve the home office. Using the example from above if you have rent and utilities totaling 1200 a month for 5 of the space you can deduct 60 a month or 720 a year.

Employees are not eligible to claim the home office deduction. It was necessary for you to work from home because your employer doesnt provide you with an alternative place to work from. If so you may be wondering if youre allowed to take the home office tax deduction for those expenses on your 2020 federal tax return.

Your employer is not required to complete and sign Form T2200. You can claim 2 for each day you worked from home in 2020 due to the COVID-19 pandemic up to a maximum of 400. Items you can write off include rent or mortgage interest utilities real estate taxes maintenance repairs and more.

Prior to the Tax Cuts and Job Acts TCJA tax reform passed in 2017 employees could deduct unreimbursed employee business expenses which included the home office deduction. However for tax years 2018 through 2025 the itemized deduction for. This will be OPTIONAL METHOD and limits you to 300 sqft at 5 per sqft or 1500.

Homeowners are able to depreciate the business portion for tax purchases too. The short answer is. Temporary shortcut method from 1 March 2020 to 30 June 2022 you may have the option of an all-inclusive 80 cents per work hour temporary shortcut method.

Go to PAGE 1 Line 19 under OTHER EXPENSES. The home office deduction reimburses you for expenses related to having a home office as long as its regularly and exclusively used for business. Taxpayers must meet specific requirements to claim home expenses as a deduction.

Home Office Expenses The Essential Guide Box Advisory Services

The Approach To Tax When You Re Working From Home Home Working Deductions

Home Office Work From Home Tax Deductions Societyone

Claiming Expenses For Working From Home During Covid 19 Taxbanter

Home Office Expenses Are You Missing Out On Tax Deductions

Tidak ada komentar:

Posting Komentar