You cannot claim for anything else. The good news is that yes if you are an employee now working from home due to the coronavirus outbreak you may be eligible to claim deductions for expenses that relate to that work.

How To Claim Working From Home Deductions Kearney Group

You need to keep a record of how many hours you work from home.

Can i claim tax if i'm working from home. Live a long way from your regular place of work. You cant claim occupancy expenses. This is to cover all your extra costs of working from home.

Business phone calls including dial-up internet access. If you work from home you can claim a deduction for the additional expenses you incur. From a tax perspective we are.

Do minor work-related tasks for example picking up the mail on the way to your regular place of work or home. It was necessary for you to work from home because your employer doesnt provide you with an alternative place to work from. With many of us working from home during the coronavirus crisis there are several home office expenses you may be able to claim as tax deductions.

Here are 8 tax deductions you may be able to claim at tax time. Unlike Running a business from home if you are an employee working from home and regardless of if you do or do not have a designated work-space there will be no capital gains tax CGT implications for your principal place of residence. Having a dedicated home office may allow you to claim a tax deduction from SARS if you are a full-time employee who spends more than half your working hours in your home office a commission-earner whose employer does not provide you with an office or a small business owner or freelancer who always works from home he says.

If youre self-employed you may be able to claim some of these expenses. This could be a diary or a timesheet. Expenses you pay because youre working from home cannot be claimed against your income.

You would then be able to claim a tax deduction on the percentage of use for work purposes. So if you worked for 40 hours over 10 weeks from home you can claim 40 X 10 X 52cents 208. Phone and Internet expenses.

But before you calculate your work from home deductions its important to know about some recent changes made by the ATO that could impact just how much you can claim. You can claim 080 for every hour you worked from home. Things you bought like a desk your higher bills like electricity or phone.

Theres a lot of misinformation floating around work-related travel living away from home allowances. To claim a deduction you will. Work outside normal business hours for example shift work or overtime.

If youre living away from home your accommodation meals and incidentals retain their character as private and domestic expenses. In April 2020 the ATO announced it was introducing a temporary shortcut method of calculating additional running expenses allowing those working from home to claim a rate of 80 cents per work hour. Self-employed If you only earn income thats already taxed like salary wages or investment income then there are a few individual expenses you can claim.

The new ATO shortcut for claiming work-from-home costs can seduce taxpayers into claiming less than they are due. Consumables such as printer ink stationery or paper. At the moment a special method known as the shortcut method is available to people working from home to claim work-related expenses as tax deductions.

You could end up with more money in your pocket at tax time. As an employee working from home generally. Types of individual expenses.

That means that you can claim a proportion of the various household utility bills which relate to the time you spend working in your home office. The Tax Office allows you to claim 52 cents per hour. Read more information here from the.

You can claim a fixed rate of 52 cents per hour worked. You cannot claim tax relief if you choose to work from home. Please note however that the special rate is only available from 1 March 2020 to 31 December 2020.

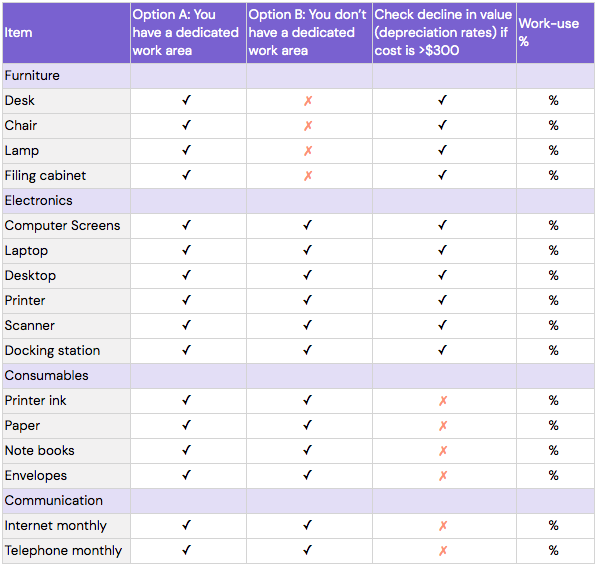

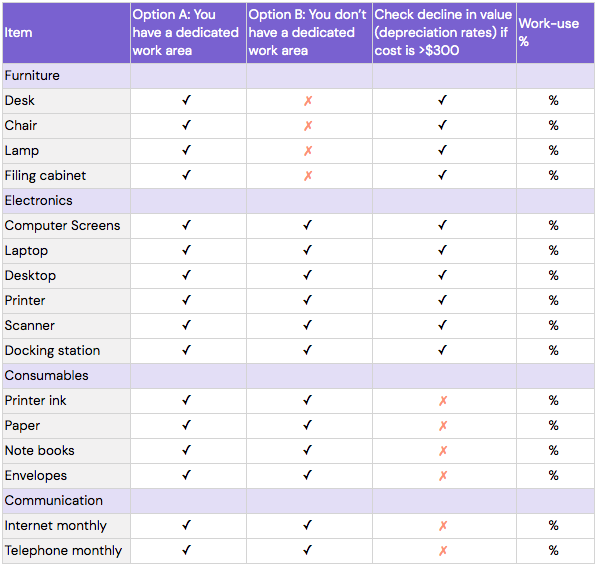

Cleaning costs for a dedicated work area. You cant claim for periods where the home office space is being used for other purposes and nor can you claim for the element of your bills that relates to the rest of your home. There are a wide range of expenses you can claim when working from home including.

Trips between your home and regular place of work cant be claimed even if you. Electricity expenses associated with heating cooling and lighting the area from which you are working and running items you are using for work. However your employer may be able to pay you a tax free allowance towards these costs.

These include expenses related to operating a home office including phone internet and designated home office furniture. Employees cannot generally claim occupancy-related expenses like rent mortgage repayments property insurance land taxes and rates. There will be no capital gains tax CGT implications for your home.

If you have a dedicated work area then this would be a much easier method to use. Home equipment such as a printer chair desk screen or computer for these items you can either claim. Heating cooling lighting and cleaning of the area you are working in.

If so you can claim the year-by-year depreciation of the work-related percentage of its value. This is a simpler way to calculate your running expenses. If you claim a personal laptop or computer as a tax deduction it can add a good few dollars to your tax refund.

Phone and internet expenses. There are two ways to make a claim for home expenses. When you do your tax.

If yes you may be entitled to claim work from home deductions on your 2020 and 2021 tax return. Phone and internet services. A good many of us work after hours at home or spend a portion of our.

Printer paper and ink and stationery. Following an extension of this temporary measure announced by the ATO you will be able to apply this rate for the period of 1 March to 30 June 2020 in your 201920 tax. However you must genuinely use them for work all or part of the time.

You can only claim occupancy expenses if you can show that. You may be able to claim tax relief for.

Tax Deductions For Tradies Give Your Refund A Boost

Working From Home Tax Deductions Covid 19

Home Office Expenses Australian Taxation Office

Working From Home Because Of Coronavirus You Can Reduce Your Tax Bill

Working From Home Tax Deductions Covid 19

Tidak ada komentar:

Posting Komentar