Yes it is possible. If there are no transactions for over 3 years EPFO rules of 2016 indicate that the account would become inoperative after 3 years post retirement.

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

The EPF organization has updated the withdrawal rule of EPF Balance which is an employee cant withdraw 100 corpus before retirement at any situation.

Can i withdraw my epf account 2. Details on Malaysias EPF KWSP Account 1 VS Account 2 withdrawals. Employees can make a PF withdrawal claim on the EPFO member portal by following the steps mentioned below. It is solely about making homeownership possible and more affordable.

Even if you have resigned or are going through unemployment situation then also cant withdraw 100 balance from the EPF account. An employee can withdraw up to 90 of the PF amount after attaining the age of 54 or one year before the age of superannuation whichever is later. Hence considering all these rules it is always best to transfer your old EPF accounts to the existing active EPF account immediately.

Accessing PF funds through the physical application method You can submit an application form at your local EPFO office. On the other hand 100 can be withdrawn after 2 months of constant unemployment. But if youre planning for a job change then you can transfer the EPF amount to the company youd join.

You can withdraw epf only when you have no job and 2 months have been passed since your last employment in other words you should be unemployed for at least 2 months. Steps for EPF Withdrawal Online. If you still not respond and not withdraw then they move to SCWF.

Information is for general reference only is an unofficial summary based on EPFs official website. You have the option to withdraw EPF savings at age 50 or 55 either partially or fully or at age 60 when you can then withdraw any amount at any time. An employee can withdraw up to 50 of his PF amount from his EPF account.

The decision has been taken by the labour ministry due to the second wave of the Covid-19 pandemic. Chief EPF Officer Alizakri Alias said i-Lestari will provide some relief to those financially affected during this period of concern and uncertainty. You can make up to 3 withdrawals from these criteria.

Additional forms documents required. According to the PF withdrawal rules you can submit a PF withdrawal application through the EPF portal. From the restrictions we can see that the EPFs withdrawal options serve a very specific purpose.

An individual must be 57 years old to withdraw up to 90 of the amount of his PF account Earlier the age limit was 54 years. These accounts can be merged into another EPF account or individuals can withdraw the amount using UAN number. An individual can choose to withdraw from their EPF account for various reasons such as settling down in a foreign country or premature retirement as a result of any physical or mental disability.

When you reach a certain age the EPF allows you to withdraw partially or in full the savings in Account 2. They can expect their savings to be deposited into their bank accounts from 1 May 2020. Though in practice this does not happen as it is not possible for EPFO to track these things and employee also finds convenient to clear off the account while leaving job as he assumes hassles in claiming back the.

However members can apply for lesser amounts as well. The amended rules do not allow an employee to withdraw the ent. Hello Below are the key takeaways from the latest press-release released by the Ministry of Labour Employment regarding EPF withdraw.

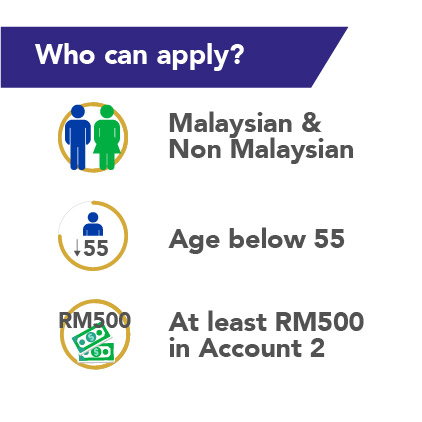

According to the Provident Fund Act an employee in their lifetime will have only one PF account maintained by the Employees Provident Fund Organisation EPFO which will be operational even as they switch jobs. Answer 1 of 8. Says that EPF members may apply for the i-Lestari Account 2 Withdrawal Scheme beginning 1 April 2020.

Savings in Account 2 can be withdrawn under specific conditions Puan Balqais. Otherwise withdraw the EPF balance immediately after 2. Housing withdrawal as this allows a member to have a roof over their head when they retire.

Hence with the UAN each EPFO member can consolidate multiple accounts into one single account. Age 505560 Withdrawal. As already mentioned if the employee has seeded hisher Aadhaar card details with ones UAN account they do not require the attestation of their employer to make a PF withdrawal.

This article is brought to you by PropSocial. You can withdraw your EPF only if you have transfered your EPF account from your previous employer. Visit the EPFO member portal.

This is the most common form of EPF withdrawal. Malaysians can start applying starting 1st April 2020 and lucky for you we have. Today we will discuss when and how EPF withdrawal can be done to meet any urgent needs.

Since PM Muhyiddin announced that citizens under 55-years-old are allowed to withdraw as much as RM500 per month from their EPF savings in Account 2 for financial aid during this precarious time many have wondered how to apply for this scheme. EPFO allows its members to withdraw non-refundable withdrawal of up to three months of basic wages and dearness allowance or 75 of the amount available in the EPF account whichever is less. You can first request transfer from old account to new account and then apply for withdrawal.

Puan Balqais shares that EPF members can withdraw savings from Akaun 2 for the following purposes. Now whenever you change a job you will be able. This is Ideal situation.

But if you havent transferred that accout and if your EPF account is new and less than 7 years old then you cannot withdraw it. Also that account needs to have been open for 7 years including the 4 years spent in this company. Instead EPFO will inform you through the contact details you linked to EPF accounts.

Thus if these are the reasons for which you are buying a home then withdrawing from your EPF account may just be the right move. Although you can withdraw the entire EPF amount even upon. But before that we must understand the Universal Account Number or UAN.

For this your universal account number UAN should be activated and linked to your Aadhaar PAN or bank details. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. The proposed new withdrawal rules will be implemented from 1st Aug 2016.

The 15 different categories of withdrawals have been divided into Account 1 only Account 2 only both accounts withdrawals.

How To Own A New Home Through Withdrawal From Kwsp Account 2 Kinta Properties

Pf Withdrawal Epf Withdrawal Process Online Withdrawal Status Step By Step Guide

Application To Withdraw From Epf Account 2 Begins Today

How To Own A New Home Through Withdrawal From Kwsp Account 2 Kinta Properties

Tidak ada komentar:

Posting Komentar